net investment income tax 2021 proposal

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in. The House proposal.

How Biden S Build Back Better Hits Blue States Harder

Income and Investments.

. All You Need to Know about the 38 Medicare Net Investment Income Tax how Pres. Biden Will Expand Who Pays It. Increases the top income tax rate to 396 on taxable income above 400000 for individuals and 450000 for joint filers.

For estates and trusts the 2021 threshold is. Fortunately there are some steps you may be able. Amid potential uncertainty about what may.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Expansion of the net investment income tax NIIT to cover net investment. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

All About the Net Investment Income Tax. In Income Tax Individual Tax Tax Tips. Calculate the Net Annual Value NAV by deducting municipal taxes paid during the year from GAV.

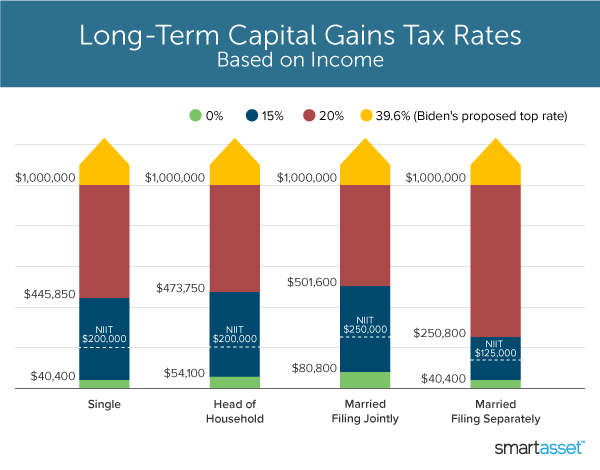

Plan Ahead For The 38 Net Investment Income Tax. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that. This would be effective for taxable years beginning after December 31 2021.

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38. Enacts a 5 surtax on modified adjusted gross income over 10000000. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Expansion of Net Investment Income Tax. One of Bidens tax proposals that has gotten little attention is a change that would shift the benefits of tax deferral in traditional retirement accounts toward lower- and middle. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular.

The proposal would repeal IRC Section 1061 for taxpayers with taxable income from all sources over 400000 and would be effective for tax years beginning after December 31 2021. High-income taxpayers face a 38 net. The AFP was introduced via a press release from the White House on April 28 2021 and includes several provisions to increase federal funding of education and health care.

Expanding the Net Investment Income Tax NIIT Observation. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. 1 It applies to individuals families estates and trusts.

Posted on July 8 2021. On the tax front consider whether to harvest income and capital gains before year-end ahead of any potential tax increases in 2021. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after.

Plan ahead for the 38 Net Investment Income Tax. Senator Wydens proposal removes the specified. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

Note that these income. Plan ahead for the 38 Net Investment Income Tax. The top individual tax bracket remains 37 versus an increase to 396.

Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax.

The proposal would expand the 38 net investment. Remember GAV will be nil for self-occupied property. D-OR in the Small Business Tax Fairness Act introduced in July 2021.

Like Kind Exchanges Of Real Property Journal Of Accountancy

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

House Democrats Tax On Corporate Income Third Highest In Oecd

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Here S How Biden S Build Back Better Framework Would Tax The Rich

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Income Tax Increases In The President S American Families Plan Itep

What S In Biden S Capital Gains Tax Plan Smartasset

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

What To Know About President Biden S Tax Proposals

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

House Democrats Propose Hiking Capital Gains Tax To 28 8

House Democrats Propose Hiking Capital Gains Tax To 28 8

What Is The The Net Investment Income Tax Niit Forbes Advisor

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation